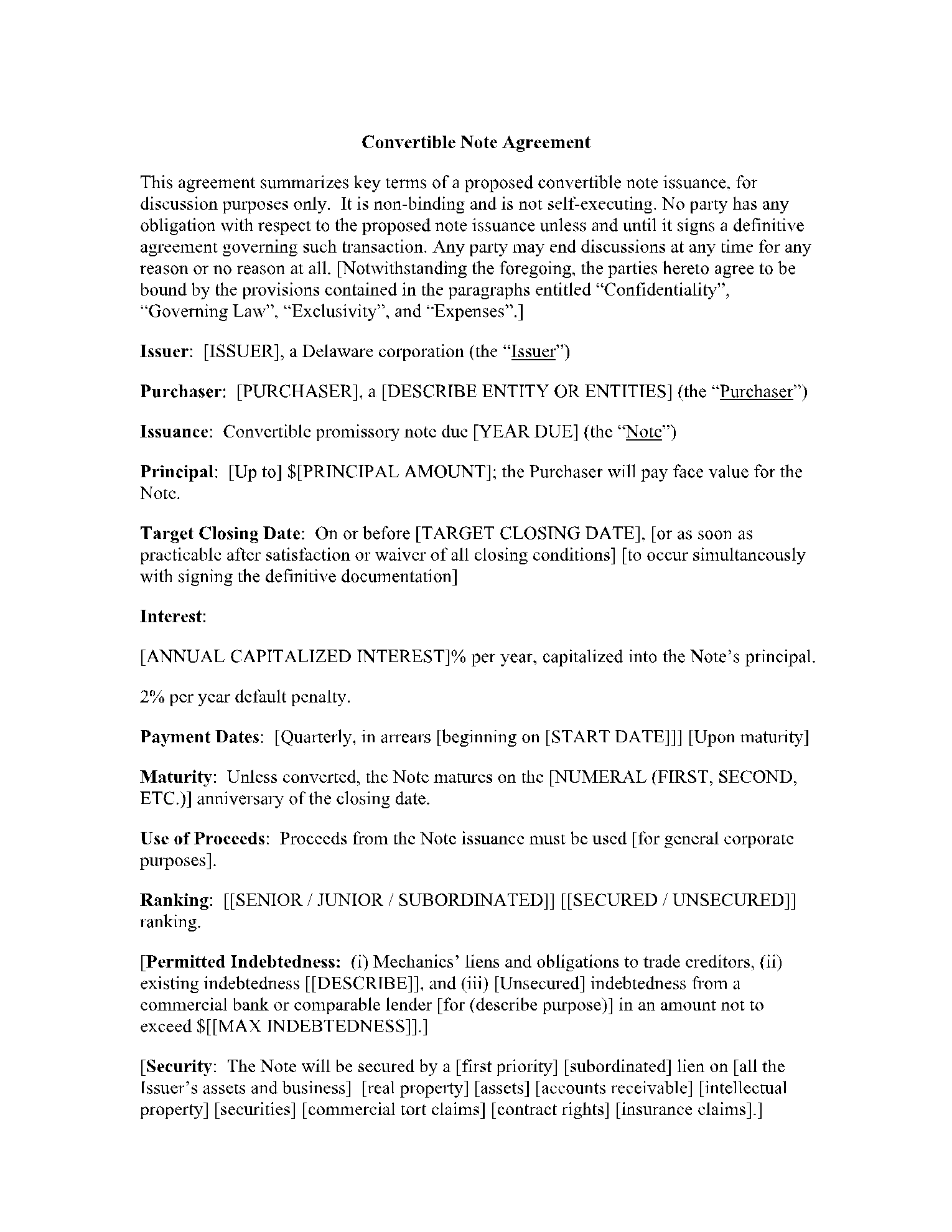

Convertible Debt Note Template - Web convertible notes are a type of loan issued by startups that convert into equity once a “triggering event” occurs. Convertible notes for startups explained: Web venture capital & startups. Definition, calculations, excel examples, and. Web convertible note agreement template. Web this convertible promissory note (note) has been acquired by the investor solely for its own. Web learn everything about convertible notes (aka convertible debt) including key parameters such as discount rates, valuation caps, as well as. Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms.

7+ Convertible Promissory Note Free Word, Excel, PDF Format Download

Web this convertible promissory note (note) has been acquired by the investor solely for its own. Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Web learn everything about convertible notes (aka convertible debt) including key parameters such as discount rates, valuation caps, as well as. Definition,.

Image of editable template convertible debt note template convertible

Web convertible note agreement template. Web venture capital & startups. Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Definition, calculations, excel examples, and. Convertible notes for startups explained:

Convertible Loan Note Template

Web convertible notes are a type of loan issued by startups that convert into equity once a “triggering event” occurs. Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Web venture capital & startups. Web this convertible promissory note (note) has been acquired by the investor solely.

Convertible Note Agreement Template Google Docs, Word, Apple Pages

Web learn everything about convertible notes (aka convertible debt) including key parameters such as discount rates, valuation caps, as well as. Web venture capital & startups. Web convertible notes are a type of loan issued by startups that convert into equity once a “triggering event” occurs. Definition, calculations, excel examples, and. Web this convertible promissory note (note) has been acquired.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Convertible notes for startups explained: Web convertible note agreement template. Web this convertible promissory note (note) has been acquired by the investor solely for its own. Web venture capital & startups.

Free 9 Sample Convertible Note Agreement Templates In Pdf

Web venture capital & startups. Definition, calculations, excel examples, and. Web this convertible promissory note (note) has been acquired by the investor solely for its own. Convertible notes for startups explained: Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms.

How Convertible Notes Convert, Template David Kircos

Convertible notes for startups explained: Web venture capital & startups. Web this convertible promissory note (note) has been acquired by the investor solely for its own. Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Web learn everything about convertible notes (aka convertible debt) including key parameters.

Convertible Note Term Sheet1

Web this convertible promissory note (note) has been acquired by the investor solely for its own. Web venture capital & startups. Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Web learn everything about convertible notes (aka convertible debt) including key parameters such as discount rates, valuation.

Web when a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms. Web venture capital & startups. Web learn everything about convertible notes (aka convertible debt) including key parameters such as discount rates, valuation caps, as well as. Web convertible notes are a type of loan issued by startups that convert into equity once a “triggering event” occurs. Web convertible note agreement template. Web this convertible promissory note (note) has been acquired by the investor solely for its own. Definition, calculations, excel examples, and. Convertible notes for startups explained:

Web Convertible Notes Are A Type Of Loan Issued By Startups That Convert Into Equity Once A “Triggering Event” Occurs.

Web learn everything about convertible notes (aka convertible debt) including key parameters such as discount rates, valuation caps, as well as. Web convertible note agreement template. Definition, calculations, excel examples, and. Web this convertible promissory note (note) has been acquired by the investor solely for its own.

Web When A Startup Issues A Convertible Note, The Investor Provides Funding In Exchange For A Promissory Note, Which Outlines The Terms.

Web venture capital & startups. Convertible notes for startups explained: